India’s Diamond Trade Is Suffering. Why Isn’t America’s?

Indian manufacturers view the current market situation as something close to a crisis. The desperation is similar to that during last year’s deep downturn. Polished prices are falling, and sightholders are losing money on rough.

But American dealers are happier. They say there is demand from retailers, albeit not at the peak levels they saw in 2021 and early 2022. They enjoyed decent sales at the Las Vegas shows, and trading is better now than before the exhibitions. So why the discrepancy?

Roller-coaster market

Last year’s market crash resulted from a mixture of factors. Synthetics, inflation and high interest rates reduced consumer demand for natural diamonds in the US. China was extremely slow (and still is), as consumers preferred gold for investments. Strong jewelry demand in India somewhat offset this.

Those demand trends have remained broadly steady since then, save for a modest drop-off in retailers promoting synthetics in early 2024 as margins narrowed.

Yet supply conditions have fluctuated. In 2023, the demand slump led to a glut of polished, especially of less desirable goods such as SIs with easily visible inclusions. India observed a voluntary freeze on rough imports from October 15 to December 15, 2023, on the recommendation of the Gem & Jewellery Export Promotion Council (GJEPC) and other trade bodies.

Image: Workers at Indian manufacturer Star Rays. (Star Rays)

This improved the situation in the short term. Trading picked up in the first quarter of 2024, but the recovery was shallow, resulting from inventory gaps within the trade rather than consumer demand. The rebound was also patchy: The market for SI diamonds did well for a few months, but VS and higher clarities slumped. By May, overall inventories were rising sharply.

Indian manufacturers are in the eye of the storm. Some of them had a decent JCK Las Vegas show, which ended in early June, but sales have since tailed off. Many are struggling to sell even when they reduce prices, as dealers and retailers are only buying for specific needs.

Of course, the diamond trade is broad, and not every segment has been as weak as the bread-and-butter round goods from 0.30 to 1.50 carats.

Overall, though, polished prices have fallen at a faster rate than rough, leading to losses for manufacturers. Cutting firms are reluctant to make sharp reductions to polished output, as losing workers, rough supply and credit lines can have a long-term impact. Therefore, production cuts have not matched the decline in sales.

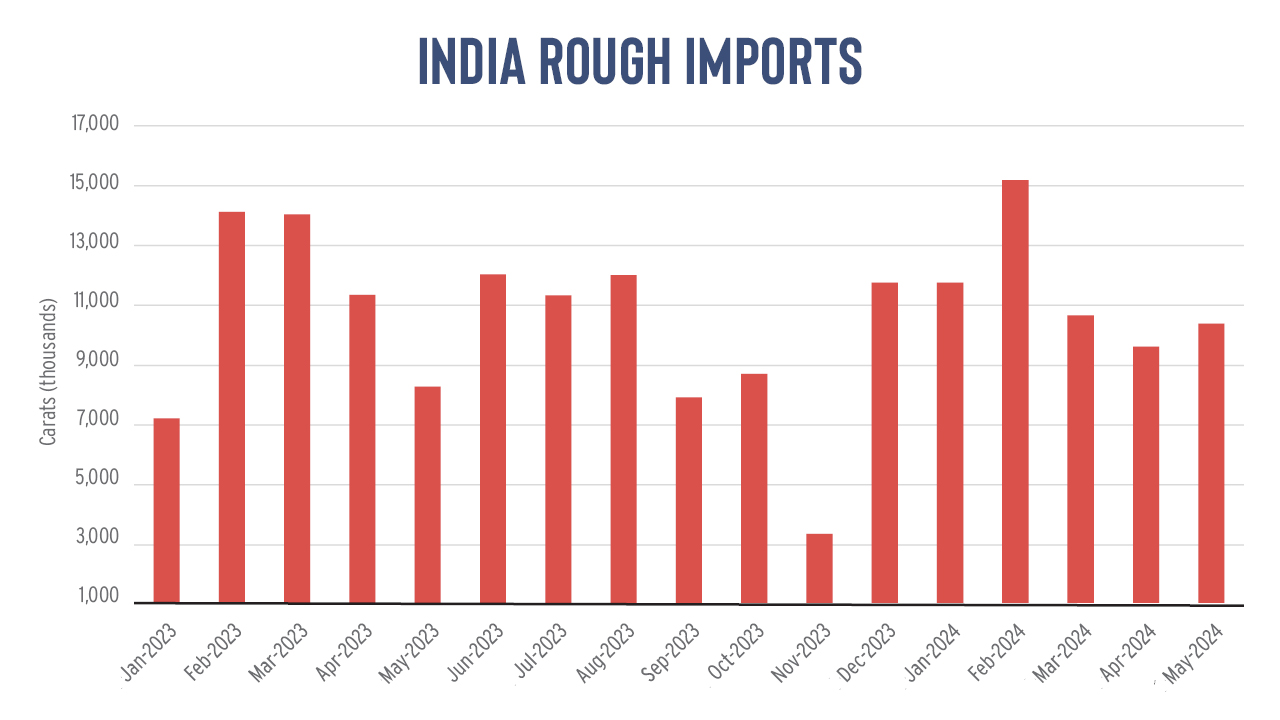

Imports and inventory

India’s imports of rough diamonds — an indicator of manufacturing activity — quickly returned to pre-moratorium levels in early 2024. This trend did not align with sluggish polished exports, suggesting the country brought in too much rough relative to demand.

Rough imports by volume rose 5% to 57.7 million carats in the first five months of 2024, according to Rapaport calculations based on data from the GJEPC (see graph). By value, the total declined 3% year on year to $6.54 billion, but this reflected a drop in rough prices.

This came despite India’s polished-diamond exports falling 21% year on year to $6.66 billion for the same period, with volume down 15% at 8.1 million carats.

Based on data from the Gem & Jewellery Export Promotion Council (GJEPC).

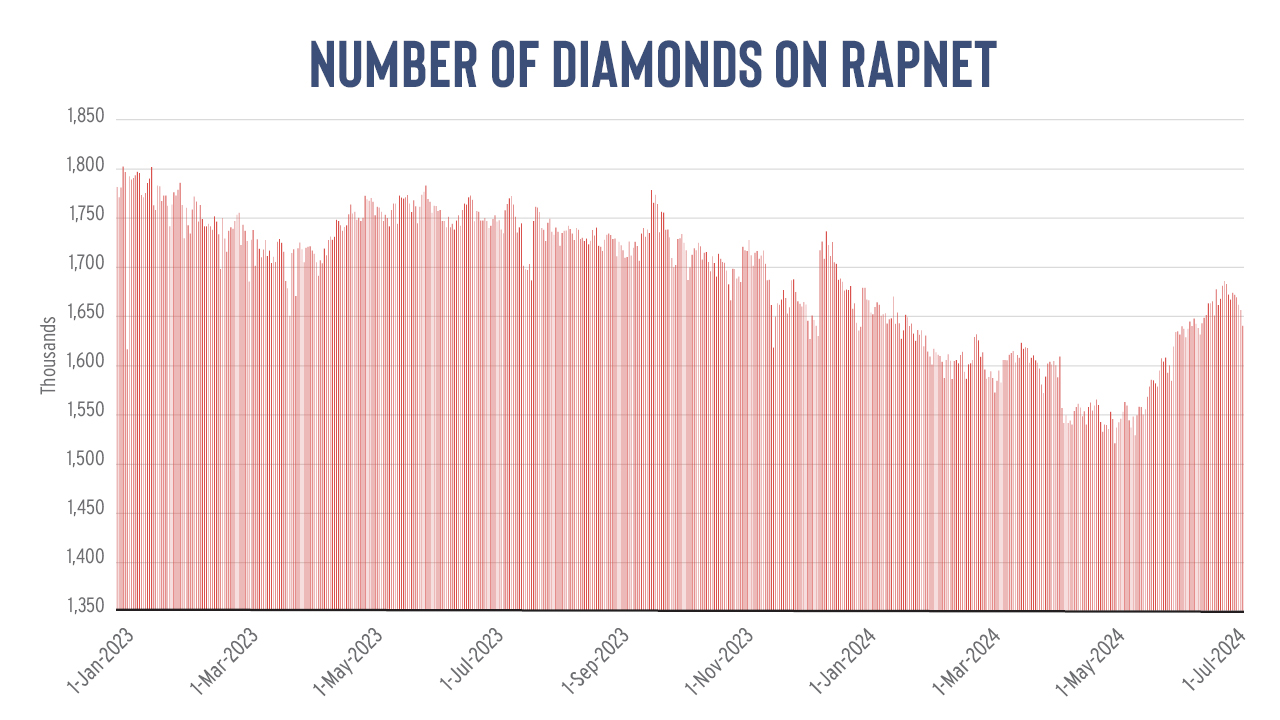

Global polished inventories were high in 2023 through to October. They started declining from November onward as India’s import freeze lowered production. The total number of diamonds listed on RapNet fell to 1.5 million in early May but has risen steadily since then, reaching almost 1.7 million on July 1 (see graph).

Based on RapNet data.

India has borne the brunt of this inventory growth. For the key size ranges of 0.30 to 0.39, 0.50 to 0.69 and 1 to 1.49 carats, the number of round, D- to M-color diamonds with flawless to I1 clarity on RapNet located in India rose 94% to just over 119,000 on July 1 compared with three months earlier. However, the number of stones located in the US grew by a more modest 22% for the same period, reaching just under 17,000 on July 1 (see graph).

Based on RapNet data.

Manufacturers are struggling to reduce these inventories. American dealers are buying only when they have a specific need, as they fear further price drops. Chinese retailers are not buying at all, and, according to reports in the industry, are even selling unwanted goods back to the market.

America might start to see more challenges if decreases in wholesale prices impact consumer prices. For now, however, the US industry doesn’t have India’s problems to the same extent.

It is true that inventories in the US trade have risen. Retailers can be selective and use memo to their advantage. But dealers can be more nimble than their counterparts in India. They have healthier inventories than Indians — meaning the quantity and types of goods they hold are better aligned with demand — and can take on the exact items they need without having to worry about workers, credit lines, and rough supply. This is consistent with the general trend for inventory crises to affect those higher up the supply chain first.

“It’s not like the wholesalers are in a much better place, but they can still figure out how to make a little more money than the manufacturers,” said Nilesh Chhabria, chief operating officer at Mumbai-based manufacturer Finestar Jewellery & Diamonds. “Because they can pick and choose what they want, they can move the goods according to what the clients require.”

Structural differences also explain the divergence, said Ari Jain, chief financial officer at New York-based wholesaler House of Diamonds, in an episode of the Rapaport Diamond Podcast that will be published next week.

“A lot of Indian manufacturers rely on debt, and debt in a downward price-trending market is very difficult to deal with,” Jain noted.

This also makes it harder for them to sell on memo — retailers’ preferred method during a period of falling prices, he added. Suppliers with less debt have fewer cash flow needs and can afford the luxury of waiting for the client to make the end sale.

“Whoever has debt and the prices are going down, they are…going to have to sell very cheap to raise liquidity, and they’re going to have to sell very quickly,” Jain commented.

Freeze and thaw

The situation highlights some deep-seated issues in the industry.

Major events and global trends can hit diamond demand hard and fast, as happened with the pandemic, global inflation, and China’s economic slump, to name just a few examples. The peaks and troughs tend to be extreme, as was the case during the Covid-19 lockdowns and the subsequent boom. Indian manufacturers are unable to be as cautious as perhaps they should, because reducing production has consequences.

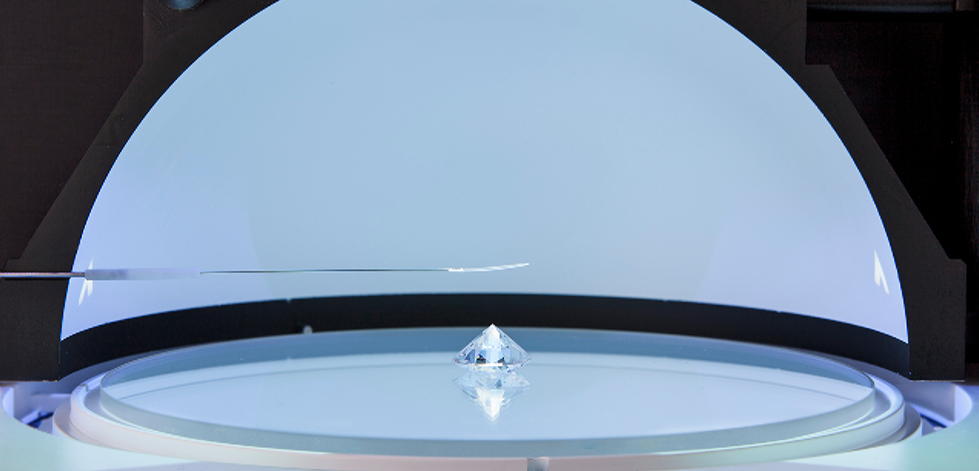

Image: Rough diamonds. (Shutterstock)

However, as David Kellie, CEO of the Natural Diamond Council (NDC), said in Las Vegas this year: “When the consumer buys diamonds, all the other problems don’t exist.”

Indian manufacturers are crying out for more marketing to promote end demand. GJEPC chairman Vipul Shah said this would be the Indian sector’s focus, rather than repeating last year’s import moratorium.

“If we don’t create consumer confidence and enhance marketing efforts, [an import freeze] is a temporary solution,” echoed Akshay Shah, director of sales for the solitaire division at Indian manufacturer Dharmanandan Diamonds.

In the meantime, the Indian industry needs to find ways to cope when sales are slow. That might require some more fundamental changes to the industry.

Main image: Rough diamonds on an Indian flag. (Shutterstock)