Diamond Prices Fall as Retail Slump Continues

RAPAPORT PRESS RELEASE, July 4, 2023, Las Vegas… De Beers’ 10-year sales deal with the Botswana government was a boost for the industry. Repeated delays, reported disagreements and threats of a breakup had created uncertainty. It remains to be seen how the new contract will affect sightholders, since the new terms grant state-owned trader Okavango Diamond Company a greater share of the country’s rough.

The market slowdown continued in June as weak US retail demand put the midstream under pressure. Jewelers avoided inventory purchases, buying only for specific orders and showing a preference for memo deals. Manufacturers maintained reduced polished production levels in response to lower sales and thinner profit margins.

Dealer activity slowed amid falling prices. Synthetic diamonds also significantly damaged the natural-diamond market, especially larger sizes and engagement rings. Many of these trends were already visible in previous months but intensified during June.

The Chinese market was sluggish. The economic slowdown and depreciation of the yuan affected demand in the mainland. Trading was predictably muted at the Jewellery & Gem Asia Hong Kong show.

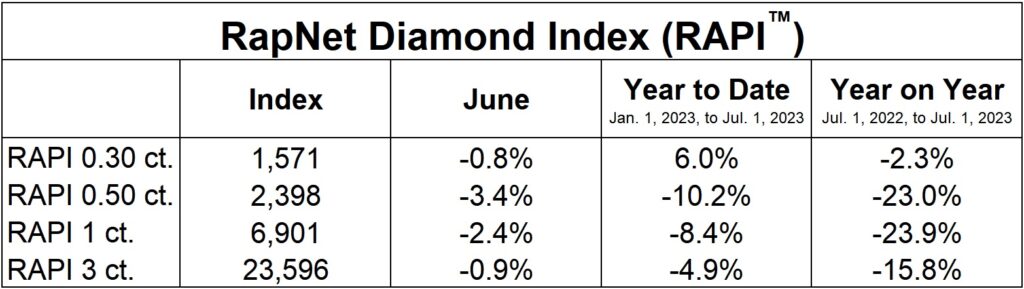

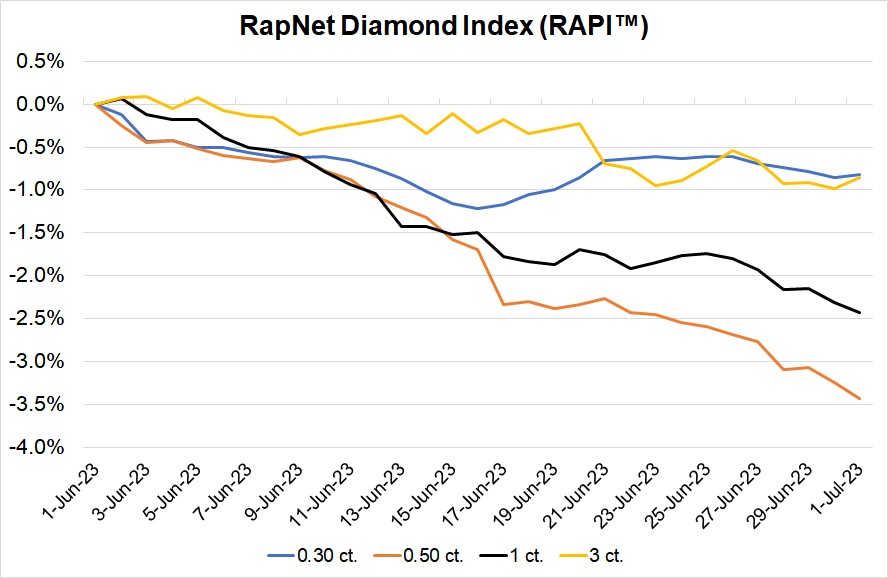

The RapNet Diamond Index (RAPI™) for 1-carat polished diamonds fell 2.4% in June. It stood at 6,901 on July 1 versus 7,537 at the beginning of the year. The RAPI also declined in other sizes and continued to downtrend during the first four days of July. Better-quality 0.50- and 1-carat diamond prices declined by over 23% year on year.

© Copyright 2023, Rapaport USA Inc.

Polished inventory remained high but stable due to low production. Factories in India extended their May summer closures and kept their manufacturing volumes under control once they reopened. The number of diamonds on RapNet fell 1.5% during June, coming to 1.75 million on July 1. However, the drop in supply was not enough to offset the slump in demand.

Demand for rough diamonds above 0.75 carats was weak; cutters were focusing on smaller stones to keep factories running, since demand for smaller natural polished diamonds persisted. Petra Diamonds and Trans Atlantic Gem Sales (TAGS) canceled their June tenders due to market conditions. India’s rough imports fell 19% year on year to $1.17 billion in May, the country’s Gem & Jewellery Export Promotion Council (GJEPC) reported.

Synthetic diamonds continued to impact sales of naturals in the SI1 to I2 range, as they give consumers the option of an eye-clean stone for the same cost or lower. While falling prices and margins prompted companies to leave the lab-grown sector, De Beers’ launch of lab-grown engagement rings under its Lightbox brand granted synthetics additional credibility. So did Indian Prime Minister Narendra Modi’s gift of a 7.5-carat lab-grown diamond to US First Lady Jill Biden.

The high end remains the main pocket of strength. Higher US interest rates have increased the wealth of the richest Americans. The middle and lower-income classes are limiting their spending, as the economic situation has reduced their disposable income. This in turn has reduced demand for bread-and-butter polished goods of 0.30 to 3 carats. India’s expanding domestic retail market is one of the few segments to show meaningful growth.

There was some cause for optimism: US inflation dropped to 4% in May, and the Federal Reserve decided to pause its interest-rate hikes in June. The financial markets are waiting to see whether the Fed resumes its rate increases at its next meeting on July 25 and 26.

Rapaport Media Contacts: media@rapaport.com

US: Sherri Hendricks +1-702-893-9400

International: Avital Engelberg +1-718-521-4976

About the RapNet Diamond Index (RAPI™): The RAPI is the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet® (www.rapnet.com). Additional information is available at www.rapaport.com.

Main image: A polished diamond. (Shutterstock)