De Beers’ Price Hike Exposes Profitability Concerns

Manufacturers are split on whether small diamonds deserved such a sharp increase.

Last week, De Beers did something it hadn’t done since the boom of early 2022: raise rough prices at two consecutive sights.

Customers turned up at this month’s sale to find that the smallest stones cost around 10% more than in January, when the miner already implemented a similar hike.

What’s especially unusual is that the company has zoomed in on a specific segment, namely the minus-7 sieve sizes — weighing around 0.03 carats — that produce tiny melee. In one subcategory, prices have risen around 30% since the start of the year, sources said.

“I don’t think anyone was expecting it,” a rough-market insider said on condition of anonymity.

Many dealers had predicted De Beers would wait to see demand levels at the March Hong Kong shows — which begin this Wednesday — and the speed of China’s recovery before making further tweaks.

The hot market for smalls — in contrast to weakness in most categories — is because the resulting polished is popular among the high-end brands that use melee to make fine jewelry and watches. The rough has also been in short supply in recent months because of a lack of Russian production, while it’s also become a favored choice among manufacturers looking to combat thin profit margins by filling factories with lower-cost rough.

Sights vs. tenders

The change goes some way toward correcting a discrepancy between rough prices on the primary and secondary markets, market insiders explained. Sightholders were getting a relatively good deal on the smalls, since De Beers reacted conservatively to the boom the segment enjoyed in the second half of last year. This enabled them to profit from reselling the rough to other manufacturers. (Not a lot of information is available about the prices Alrosa is charging the contract customers that are still buying its rough.)

“Manufacturers…are buying goods secondhand from sightholders and dealers who are charging them a high double-digit profit,” said an executive at an Indian cutting firm. “If they were to be able to buy [at De Beers’ or Alrosa’s] list price, they would make a killing.”

In a peculiarity of the contract-sale system, prices don’t always correlate with polished demand at the time. Market improvements can prompt De Beers to raise prices, but they can also lead to price reductions after downturns as management attempts to stimulate buying. This happened in August 2020 after the first Covid-19 lockdowns and again last month — in larger categories — when China looked set to emerge from its recent slowdown.

The latest De Beers price increases do not fully match the demand manufacturers are seeing, another sightholder said anonymously. Suppliers in India are witnessing a gradual return of demand for the 0.30-to 0.50-carat goods, as Chinese buyers are slowly returning, but the tiniest smalls are on the opposite trajectory, he claimed.

“I don’t know why they’re targeting [the smallest diamonds] so much,” he said. “If you would ask any Indian, they would say that polished is going down in smalls. So it’s very much against the sentiment.”

Thin margins

The move also comes amid tight profit levels at manufacturers, as rough prices have largely remained high — especially on the open market — despite mixed polished demand.

“We look at profitability in the midstream and the manufacturers, and we’re very much [focused on] how…we play a responsible and sustainable role in the long term,” said De Beers chief financial officer Sarah Kuijlaars.

Stars and melees — the smallest polished items — are in strong demand, observed Vipul Shah, chairman of India’s Gem & Jewellery Export Promotion Council (GJEPC) and CEO of Mumbai-based manufacturer Asian Star. However, “we are struggling as far as the profitability is concerned,” he said in mid-February, ahead of De Beers’ price increase. He noted that the problem was more with the expensive auction and tender goods than with sight supply.

In the second half of last year, prices of rough above 0.75 carats — also known as 3-grainers — plummeted on the open market as Chinese polished demand dried up and US sales were shaky. Small stones held up better.

“We have seen a huge correction in the larger goods in rough diamonds, and all that pressure is coming on the smalls now,” Shah explained. “It’s not making sense if the profitability is not there.”

There’s a fine line between adjusting prices to match the market and making business hard for sightholders. De Beers might have crossed this with the latest hike, one of the manufacturers claimed.

“They were very, very gentle and slow when it came to price increases last year in minus-7 [sieve sizes] and minus-3-grainers,” he acknowledged. “I think they’re just overshooting it now.”

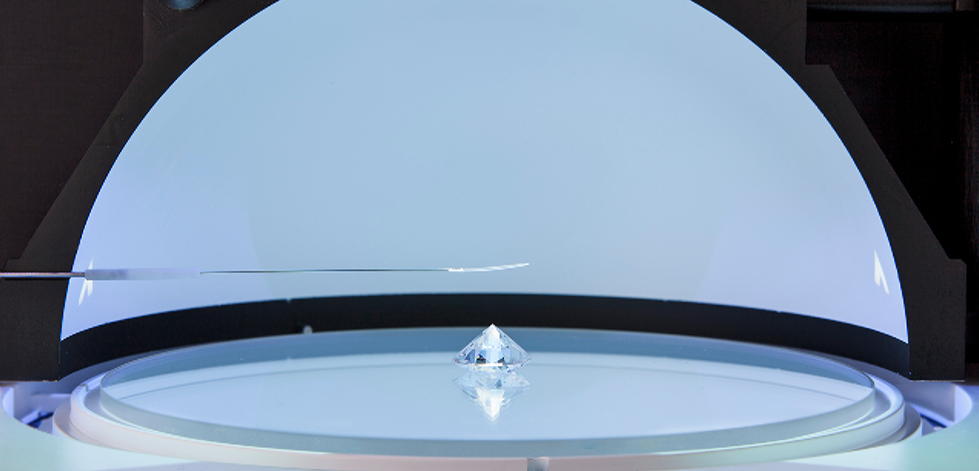

Image: Rough diamonds on display at De Beers’ offices in Calgary, Canada. (Ben Perry/Armoury Films/De Beers)